The Benefit

Medicare is federal health insurance for people 65 or older, people of any age suffering permanent kidney failure, and people with certain disabilities that have entitled them to disability income coverage under Social Security for at least the past 24 months.

There are four basic parts to Medicare and several supplement plans. Let’s look at these parts individually to see how the whole puzzle fits together.

The Details

Medigap/Supplement Plans

The Benefit

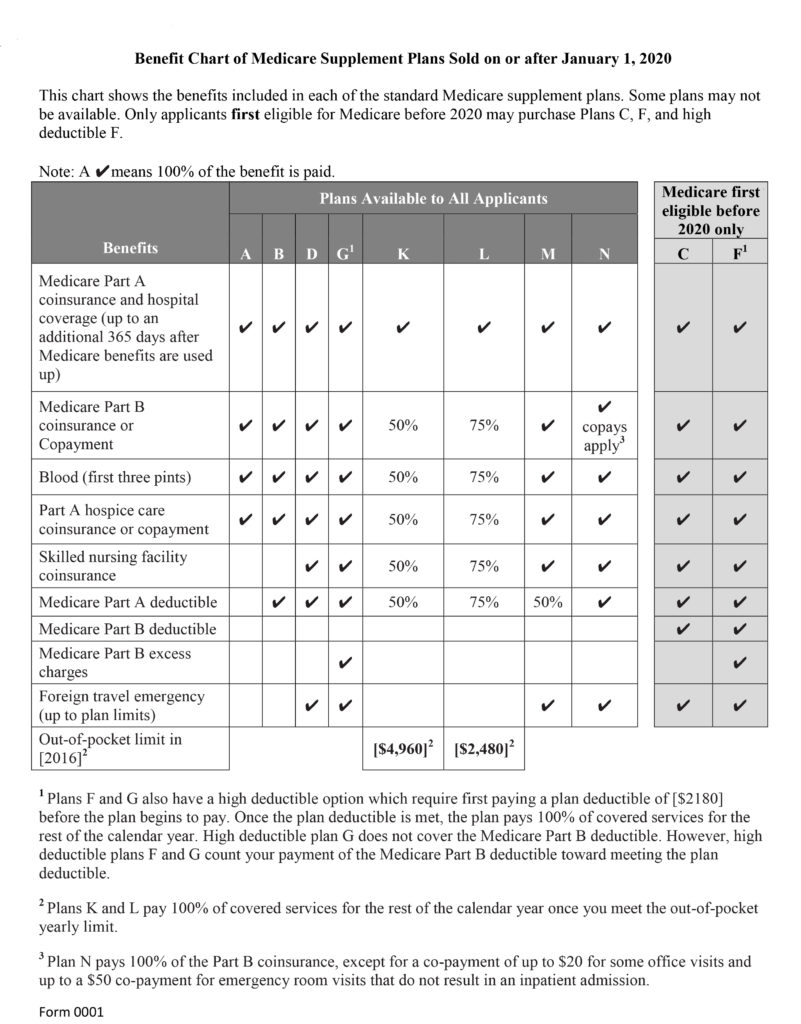

Medigap/Supplement Plans are standardized plans run by approved private carriers that help to reduce the coverage gaps in Part A & B. People either have an Advantage Plan (Part C) or an Medigap/Supplement Plan. Medigap plans all are standardized and cover the same things from carrier to carrier. The only thing that varies are the premium paid for the plan.

Some plans are issue age plans, which does not raise your premiums based on age, but can raise your rates for inflation and other factors. Attained age plans raise your premiums due to age and other factors such as inflation. You have a 6 month window from when you turn 65 to enroll in a Medi-Gap plan in which the insurance carrier cannot reject you for medical conditions.

The Details

Below is a summary of the standardized coverage for Medigap Plans: